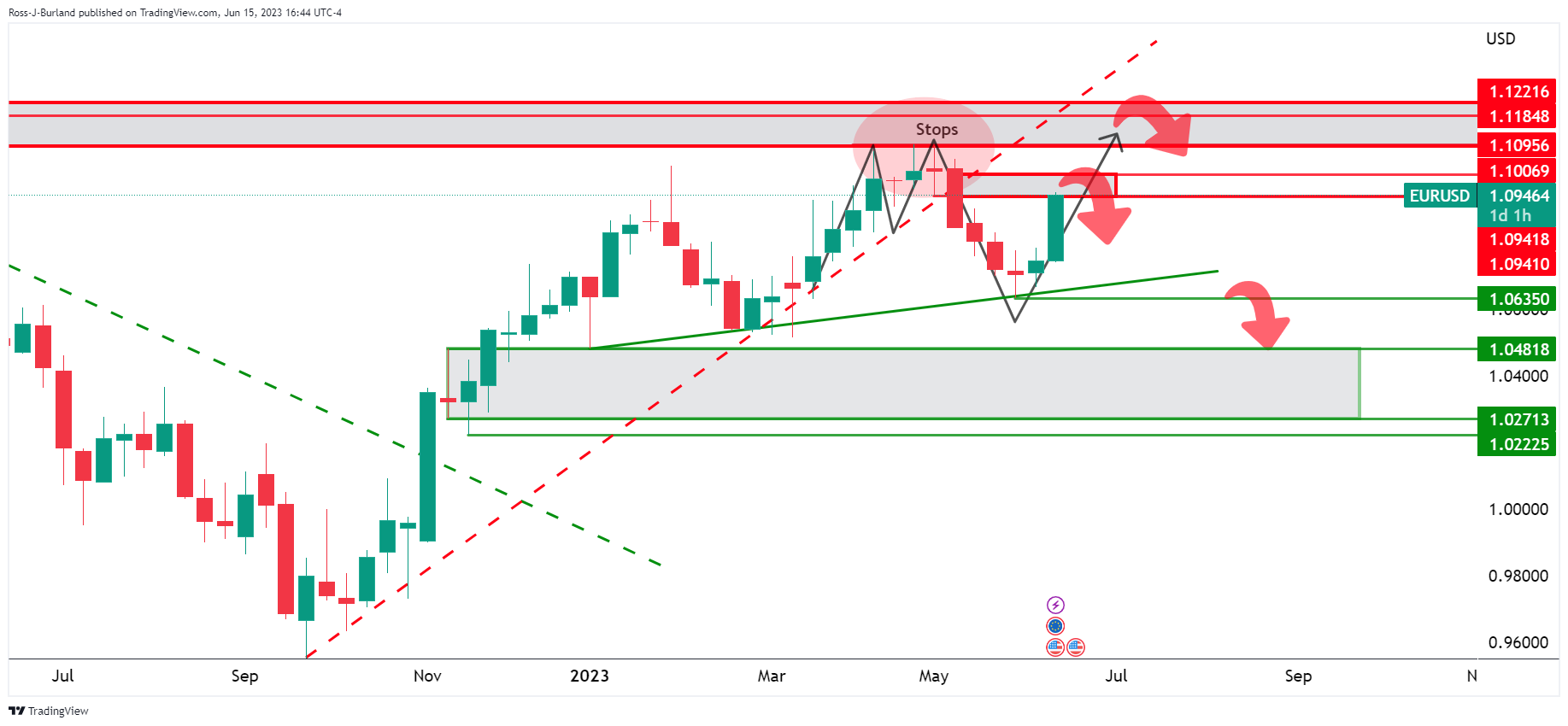

EUR/USD Price Analysis: 1.0950 guards 1.1000 and 1.1100

- EUR/USD bulls move into a key area of potential weekly resistance.

- Bears need to show up at this juncture for prospects of a move into the 1.0820s or face pressures to and above 1.1000.

EUR/USD moved to a five-week high on Thursday on the back of the European Central Bank increasing rates for the eighth straight time and signalled further tightening to bring eurozone inflation to its medium-term target of 2%.

At 3.5%, rates are the highest in 22 years and the ECB's inflation projection for this year was raised to 5.1% from 4.6%. Consequently, the price has moved into what could be regarded as a resistance area from trendline support. The following illustrates, however, prospects of a move through 1.1000 and into the tops of where the weekly M-formation shorts were established in the lows 1.1100s:

EUR/USD weekly charts

A move lower from here, however, opens risk to the 1.0820s as follows:

EUR/USD daily chart

The 1.0820s align with the 61.8% Fibonacci and prior resistance structure as illustrated above.