EUR/GBP extreme volatility post EU-UK preliminary deal

-

EUR/GBP extreme volatility with UK-EU preliminary deal.

-

Data-intensive week with UK CPI, average earnings and Bank of England.

The EUR/GBP is trading at around 0.8766 down 0.50% on the day as earlier in the European session the UK and EU leaders agreed on a preliminary 21 month Brexit transition deal.

It is going to be a data-intensive week and right off the bat the EUR/GBP is already seeing above-average volatility while Monday and Tuesday will see the G20 taking place in Argentina.

“In addition to politics, GBP should take some direction this week from economic news. The release of UK February CPI inflation data tomorrow (Tuesday) is expected to show some moderation in price pressures as the impact of sterling’s 2016 plunge starts to work its way out of the index. The Bloomberg consensus stands at 2.8% y/y. Barring a far sharper drop in UK inflation, however, we would not expect too much market reaction from this release given the scheduled BoE policy announcement on Thursday.” According to Rabobank analysts.

Next market mover is likely going to be the average earnings on Wednesday at 9.30 GMT and certainly on Thursday with the Bank of England meeting where investors will gather more info regarding the next rate hike.

ECB’s Yves Mersch is set to speak later in US session at 18.00 GMT.

Earlier in the European session, the Eurozone construction output decreased 2.2% m/m in January and increasing 3.6% y/y.

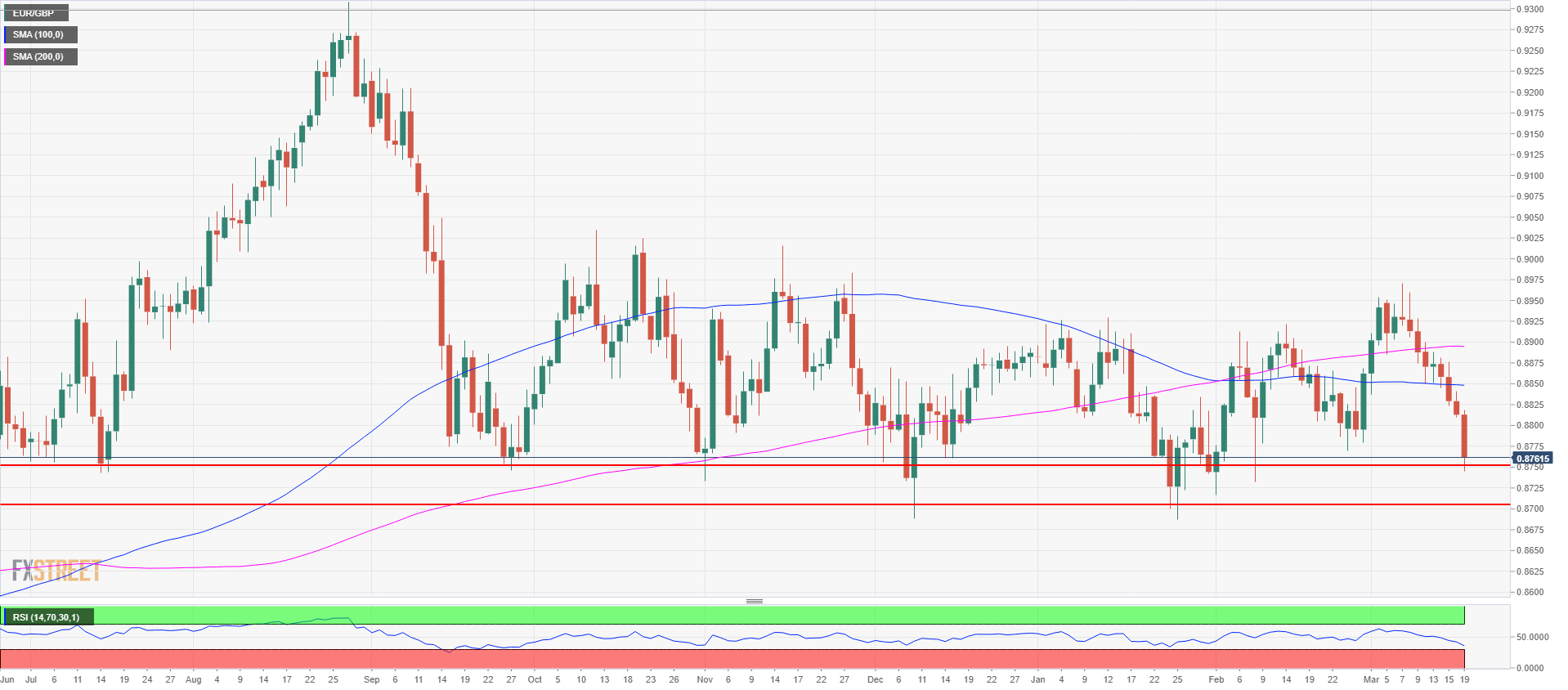

EUR/GBP daily chart

The EUR/GBP is testing the lower third part of the multi-month range at 0.8750 support, next key support is seen at 0.8700 which is the bottom of the range, after which we are pretty much in uncharted territory.

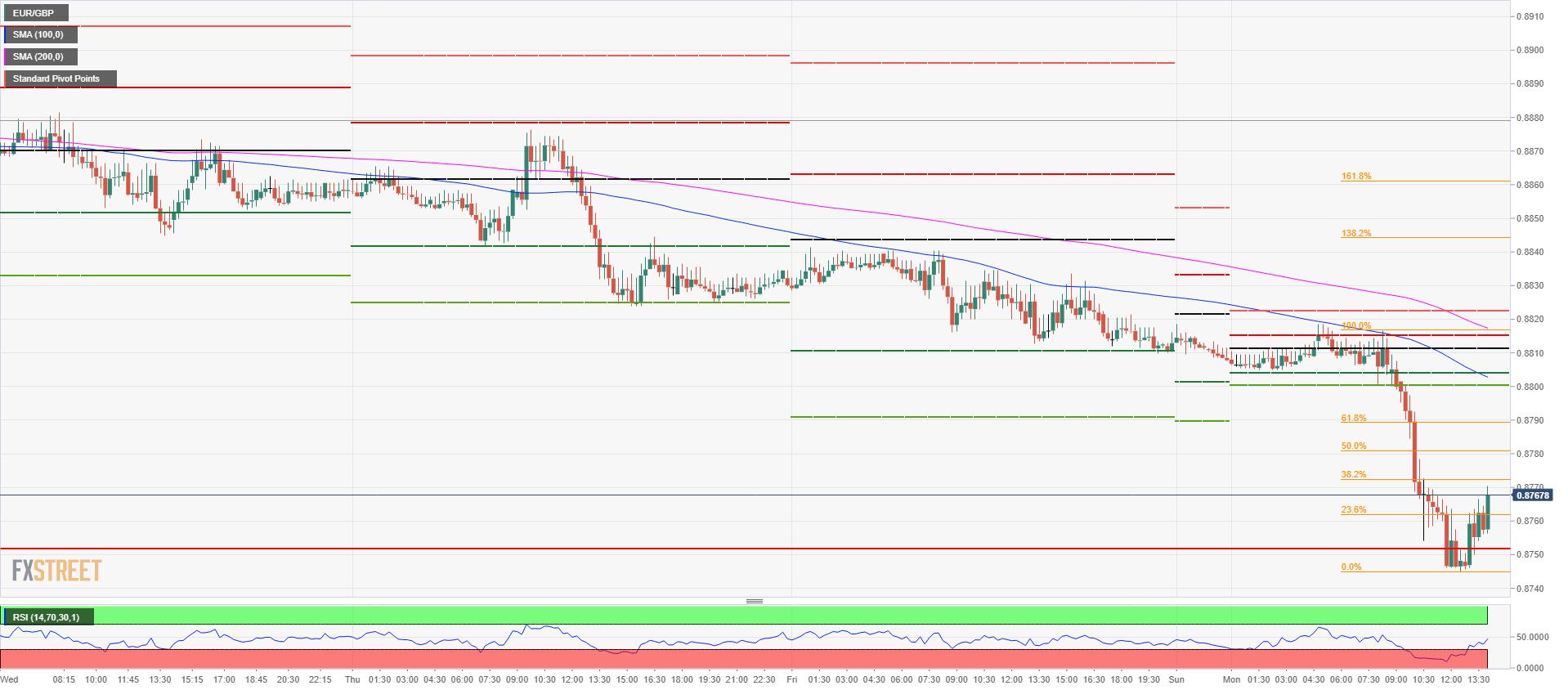

EUR/GBP 15-minute chart

The EUR/GBP exceeded its average daily range (ADR) which is usually set at 51.6 pips for the last 14 days while today saw a 71.5-pip reading so far.

The market found support at the 0.8750 psychological figure and is now consolidating at around the 23.6% Fibonacci retracement from the last intraday leg down, which was the reaction of the market after the EU-UK preliminary Brexit transition deal. Resistance is seen at 0.8780, 38.2% Fibo and 0.8790, 61.8% Fibo as seen in the chart above.