Back

17 Jul 2018

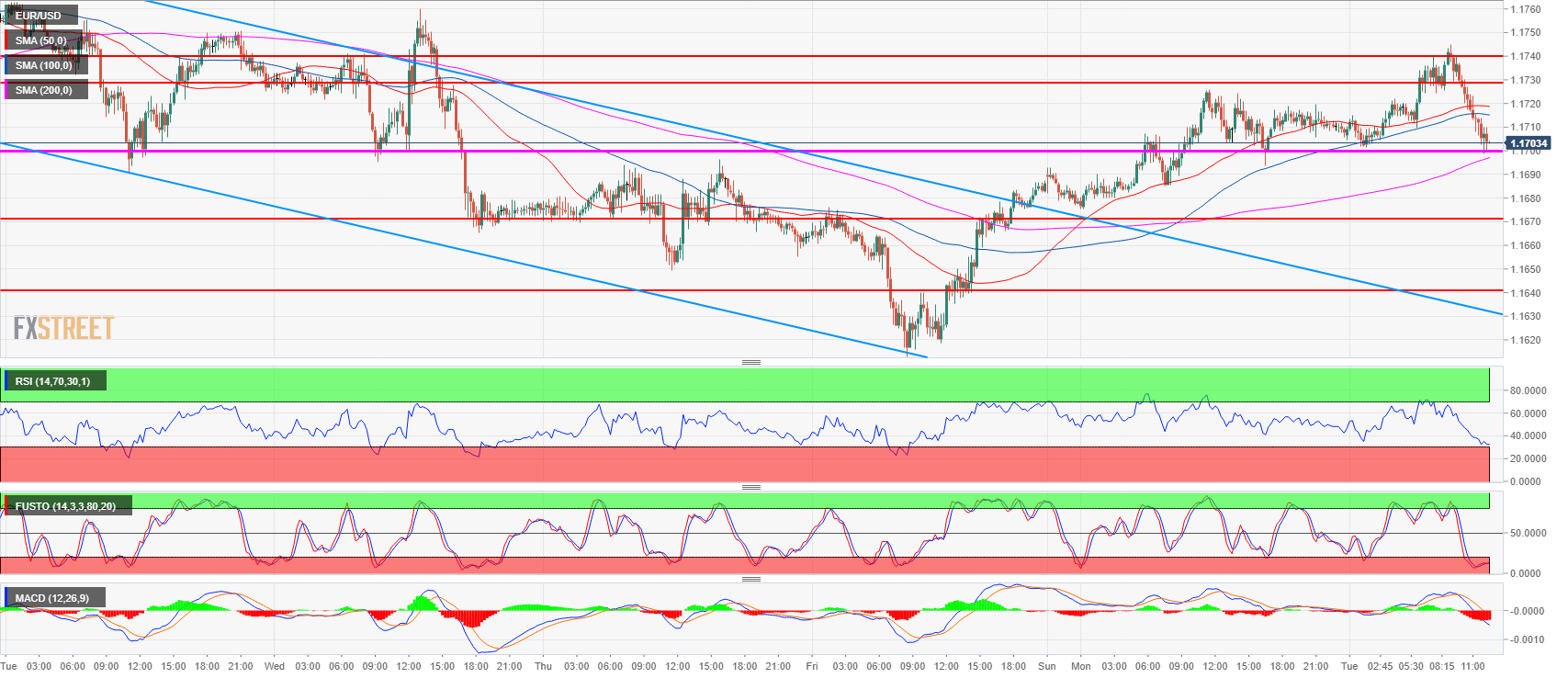

EUR/USD Technical Analysis: Back to 1.1700 figure ahead of Fed’s Powell speech

- EUR/USD is currently trying to find some support near 1.1700 after bulls challenged the 1.1740 level without being able to pierce through it.

- EUR/USD bulls are still hanging above the 1.1700 level and the 200-period simple moving average. A strong bear breakout below the level should open the gates to 1.1672 June 27 high and 1.1640-1.1649 area, key level and July 12 low.

- Fed’s Powell speech at 13:45 GMT is likely going to provide much volatility.

EUR/USD 15-minute chart

Spot rate: 1.1702

Relative change: -0.07%

High: 1.1745

Low: 1.1698

Trend: Bearish

Resistance 1: 1.1730-1.1740 area, 23.6% Fibonacci retracement from mid-April-May bear move and last week’s open.

Resistance 2: 1.1790 last week’s high

Resistance 3: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1700 figure

Support 2: 1.1672 June 27 high

Support 3: 1.1640-1.1649 area, key level and July 12 low

Support 4: 1.1613 current weekly low

Support 5: 1.1600 figure

Support 6: 1.1560 June 14 low

Support 7: 1.1508 current 2018 low