GBP/USD Technical Analysis: Bidders spinning their wheels at 1.2750 amidst descending triangle

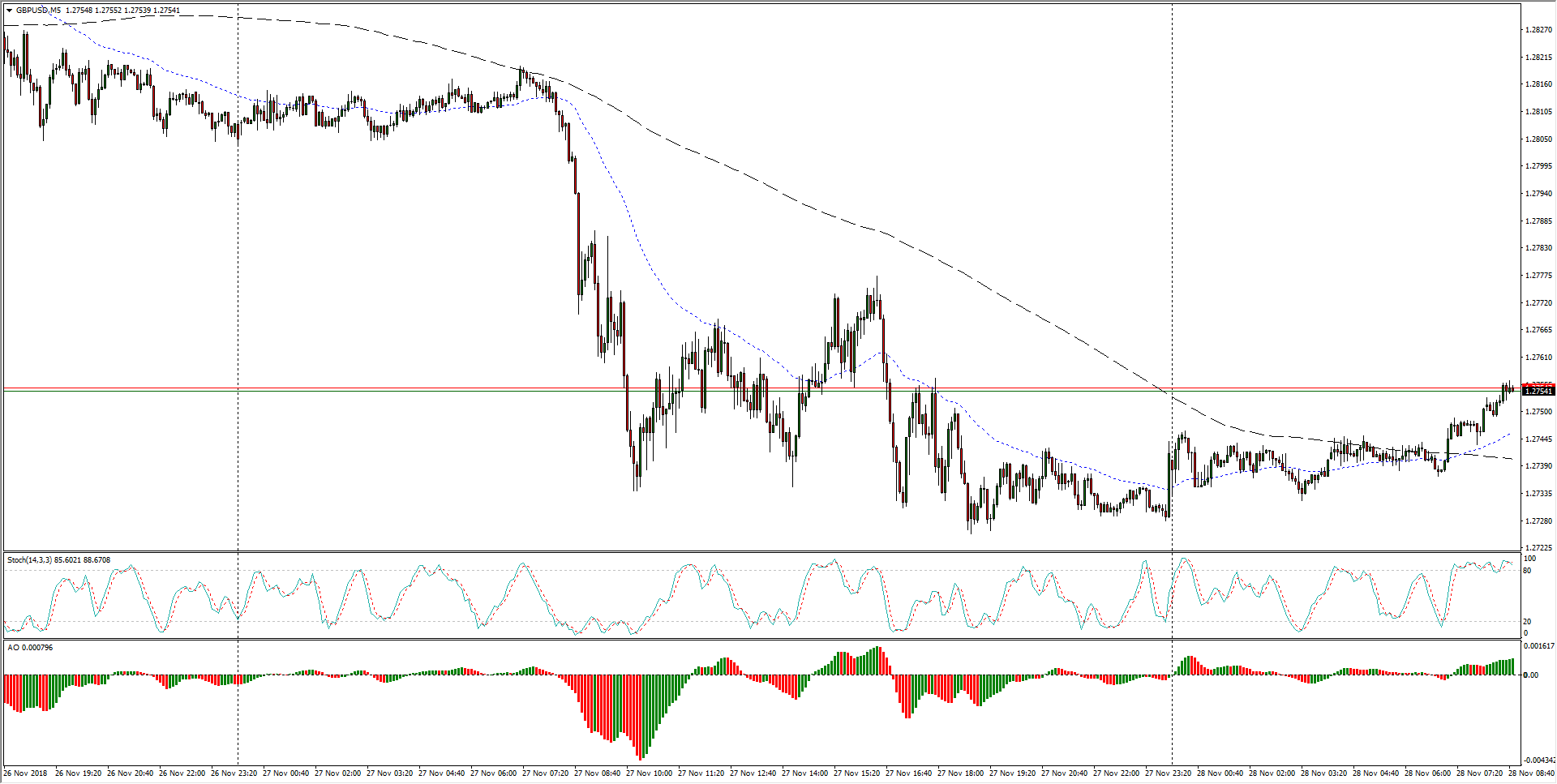

- The GBP/USD pairing is catching some bids in the pre-London session, rising over 1.2750 in early Wednesday trading, but the pair remains steeply off of recent highs, losing the 1.2800 major handle in Tuesday's trading as the Cable market remains fairly risk-off.

- An intraday floor has been priced in near 1.2725 as the Cable lifts above the 200-period moving average near 1,2740.

GBP/USD, 5-Minute

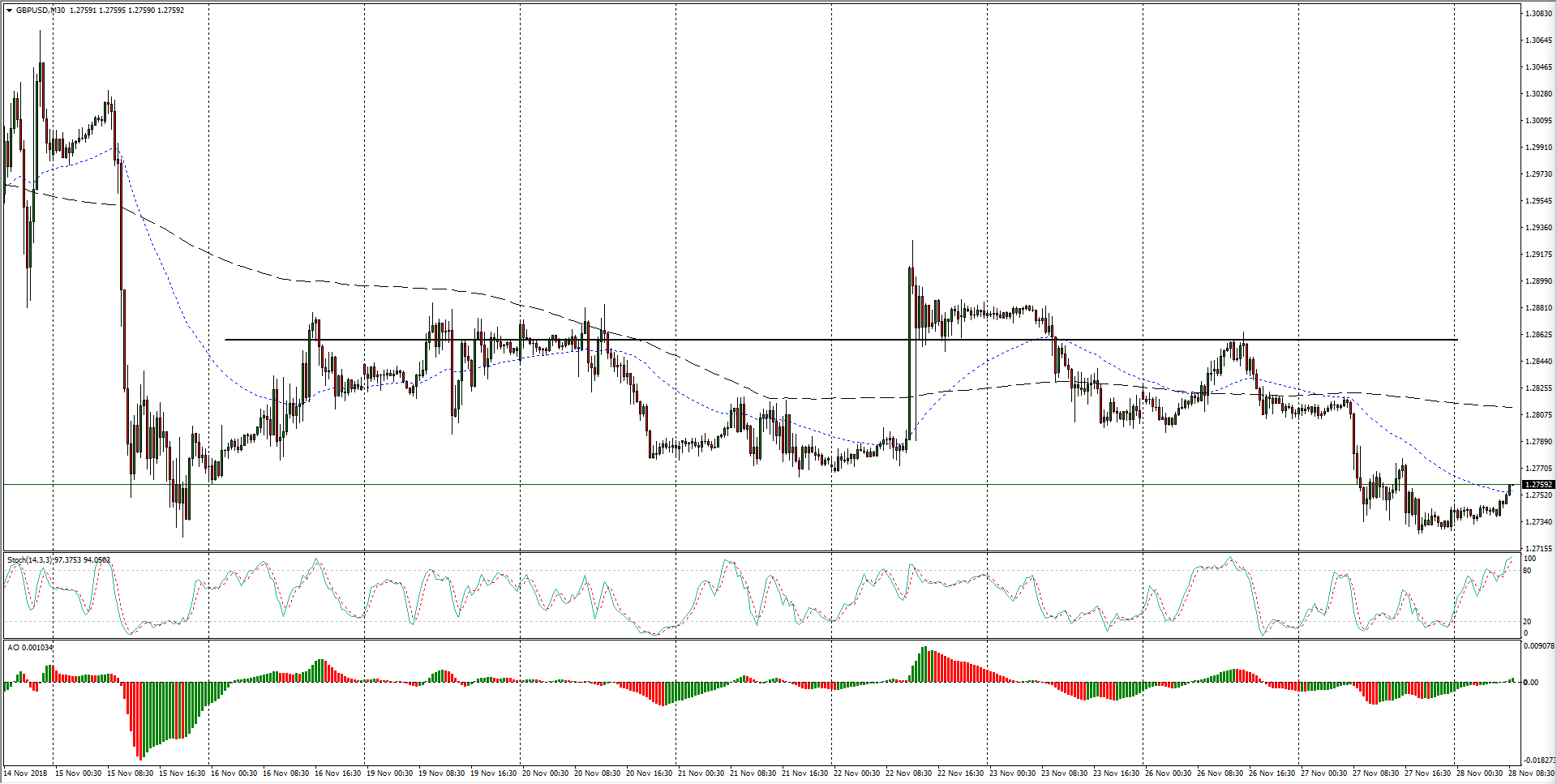

- Going back over the past two weeks, 1.2860 remains a key inflection point, and near-term bulls will be waiting for a successful break-and-retest of the congestion region before stepping up their long orders.

GBP/USD, 30-Minute

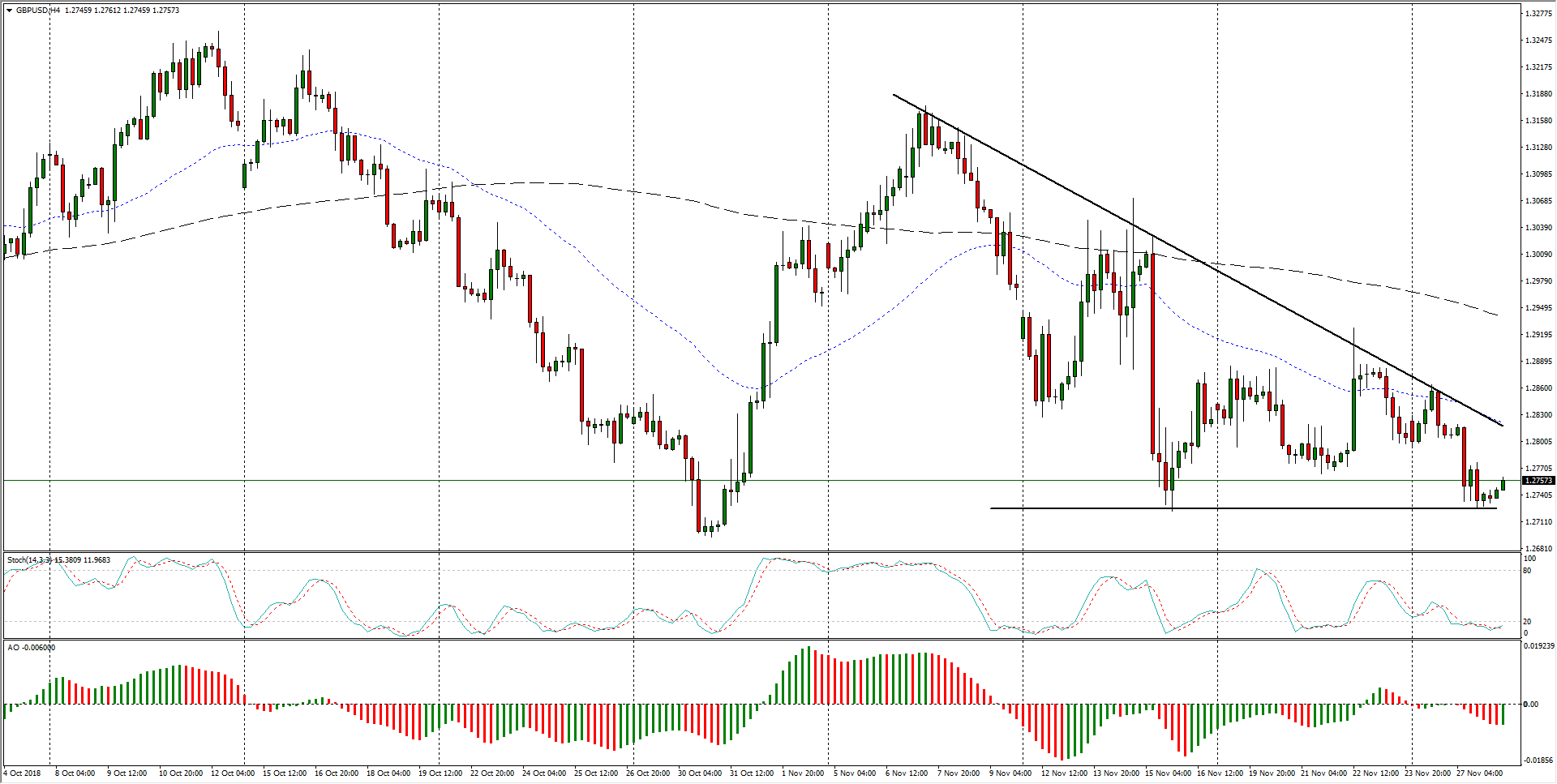

- In the medium-term, the Cable is confined neatly in a descending triangle, while a fresh break into the 1.2700 level will see further downside open up as bearish bets break free of a heavy stop zone.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.2755

Today Daily change: 21 pips

Today Daily change %: 0.165%

Today Daily Open: 1.2734

Trends:

Previous Daily SMA20: 1.2906

Previous Daily SMA50: 1.2992

Previous Daily SMA100: 1.299

Previous Daily SMA200: 1.3335

Levels:

Previous Daily High: 1.2836

Previous Daily Low: 1.2725

Previous Weekly High: 1.2928

Previous Weekly Low: 1.2764

Previous Monthly High: 1.326

Previous Monthly Low: 1.2696

Previous Daily Fibonacci 38.2%: 1.2767

Previous Daily Fibonacci 61.8%: 1.2793

Previous Daily Pivot Point S1: 1.2694

Previous Daily Pivot Point S2: 1.2654

Previous Daily Pivot Point S3: 1.2584

Previous Daily Pivot Point R1: 1.2805

Previous Daily Pivot Point R2: 1.2875

Previous Daily Pivot Point R3: 1.2915