EUR/SEK bounces off lows, back around 10.25

- The Swedish Krona gives away earlier gains post-CPI.

- The cross now appears sidelined around the 10.25 area.

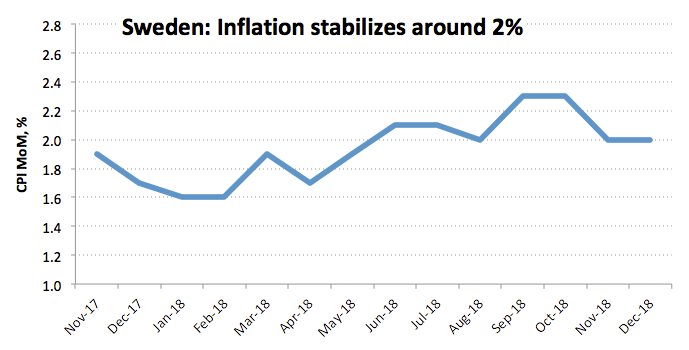

- Sweden CPI rose 0.4% MoM in December.

After an initial drop to the 10.2250 area, EUR/SEK managed to revert the down move and advance to the current 10.25 region, where it is now looking to consolidate.

EUR/SEK upside capped near 10.27

SEK appreciated to the key 200-hour SMA earlier in the session in the wake of the release of key inflation figures in the Scandinavian economy.

In fact, headline consumer prices rose in line with expectations in December, up 0.4% inter-month and 2.0% from a year earlier. Furthermore, CPIF (CPI at constant interest rates) also gained 0.4% MoM and rose above estimates at an annualized 2.2% (from 2.1%).

What to look for around SEK

Key inflation figures today leave the scenario unchanged for the Swedish Krona in the near to medium terms. The Riksbank’s recent dovish hike and subsequent minutes coming in on the same tilt plus the view that the Nordic economy could experience some slowdown in the months to come leaves SEK under pressure and opens the door for extra upside in the cross. The Riksbank, in the meantime, should remain ‘data dependent’ and keep tracking the ECB when comes to forward guidance. Consensus among traders points the next rate hike at some point by end 2019.

EUR/SEK levels to consider

As of writing the cross is gaining 0.24% at 10.2555 and a break above 10.2686 (high Jan.14) would expose 10.2808 (55-day SMA) and then 10.2950 (2019 high Jan.3). On the other hand, the immediate support lines up at 10.2195 (10-day SMA) followed by 10.1725 (low Jan.8) and finally 10.1553 (2019 low Jan.1).