Back

11 Sep 2019

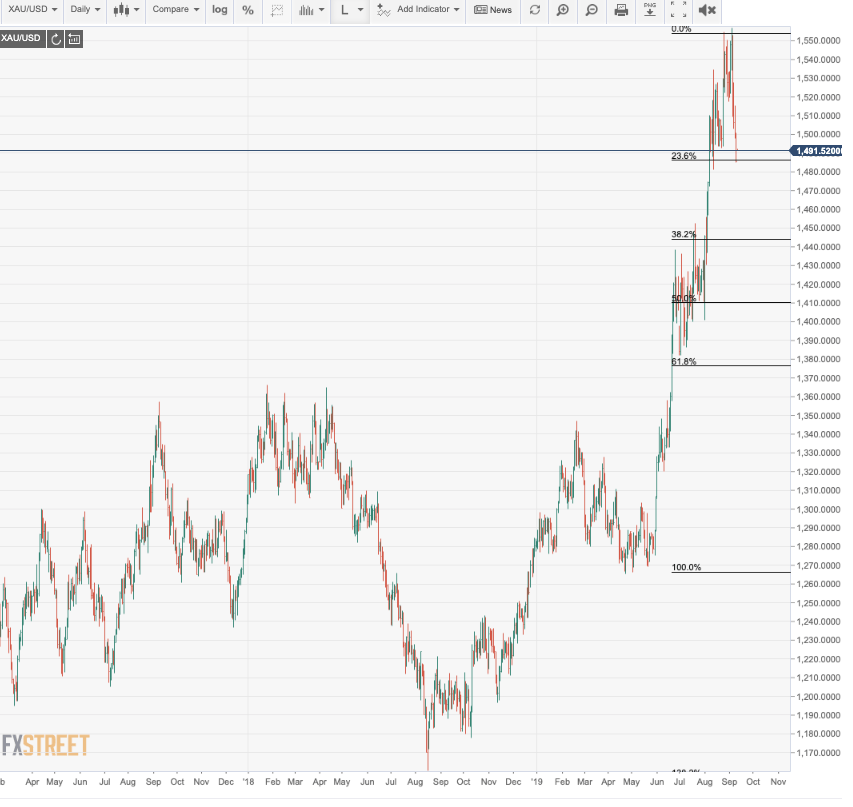

Gold technical analysis: Gold has sunk to the 23.6% Fibonacci retracement

- The next stop for Gold bears on the radar is a 38.2% Fibo retracement down at 1446.

- Bulls will need to get back above 1,550 which then guards prospects for 1,590.

The price of gold has sunk to the 23.6% Fibonacci retracement of the April-May and summer swing highs of 2019 with the next stop on the radar as being a 38.2% Fibo retracement down at 1446.

On a correction, however, the 21-day moving average is key on the upside, but the bears can approach 1,478 as the 13 August volatility spike low which guards the 19 July swing highs at 1,452.93. at this juncture. Bulls will need to get back above 1,550 which then guards prospects for 1,590 as the 127.2% Fibo target area.

Gold's Daily chart