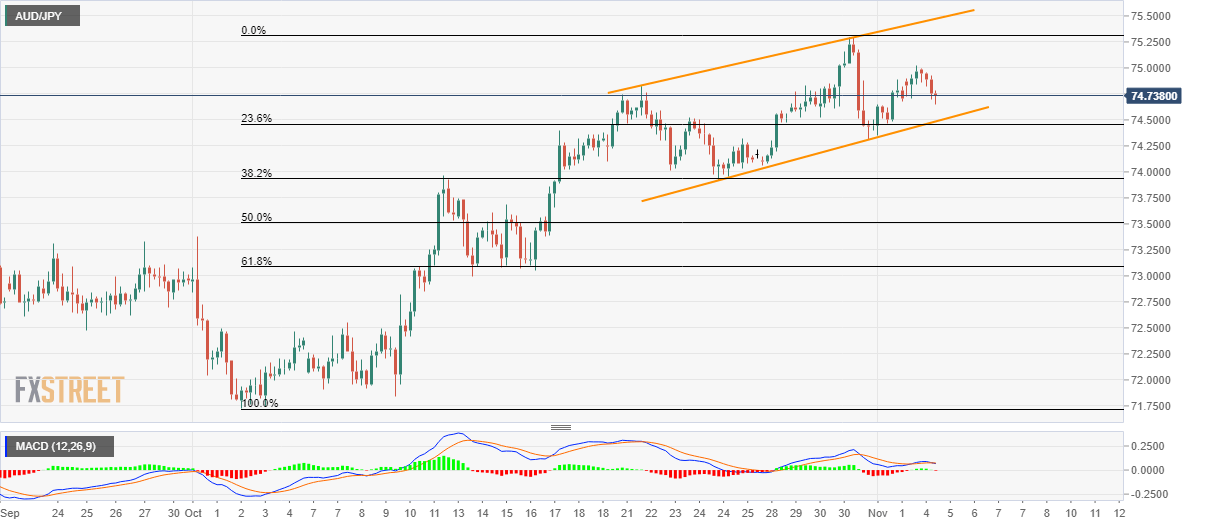

AUD/JPY technical analysis: On the back foot inside two-week-old ascending channel

- AUD/JPY keeps the near-term bullish formation intact despite bearish MACD.

- Formation resistance, July high on the buyer’s radar.

- A downside break of the channel could recall sub-74.00 area.

Despite pulling back from month-month high recently, AUD/JPY manages to remain inside a short-term bullish technical formation while taking rounds to 74.73 at the initial hours of Tuesday’s Asian session.

In addition to consolidating from late-July highs, the bearish signal from 12-bar Moving Average Convergence and Divergence (MACD) also portrays the underlying weakness in trading sentiment.

However, bears need to defy a two-week-old rising trend channel, by declining below 74.50 support, to revisit early-October high near 73.95 and 61.8% Fibonacci retracement of October month upside, at 73.10.

During the pair’s further declines below 73.10, 72.55 and 71.70 could lure sellers.

Meanwhile, 75.00 and the recent highs close to 75.30 will entertain buyers during another pullback ahead of challenging channel’s resistance, at 75.50.

Should prices rally beyond 75.50, July month top surrounding 76.30 will become bull’s favorite.

AUD/JPY 4-hour chart

Trend: bullish