EUR/GBP Price Analysis: Snaps three-day winning streak

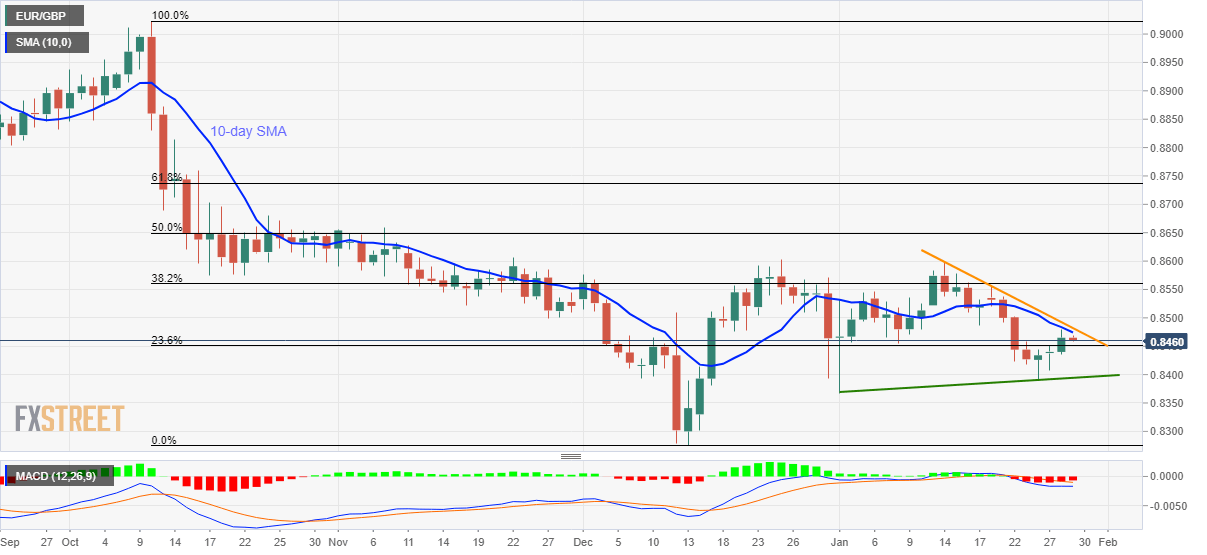

- EUR/GBP takes a U-turn from 10-day SMA following three days of rise.

- 23.6% of Fibonacci retracement acts as immediate support.

- A two-week-old falling trend line holds the key to the monthly top.

EUR/GBP declines to 0.8460 while heading into the European session on Wednesday. The pair recently took a U-turn from 10-day SMA, which in-turn drags it towards 23.6% Fibonacci retracement of its October-December 2019 declines.

In addition to 23.6% Fibonacci retracement near 0.8450, a monthly rising support line, at 0.8395 now, could challenge the bears.

However, the pair’s sustained weakness below 0.8395 might not refrain from recalling the December 2019 bottom surrounding 0.8275.

Alternatively, an upside clearance of 10-day SMA, at 0.8475, needs validation from the short-term falling trend line, near 0.8485, to confront the 38.2% Fibonacci retracement and monthly top, respectively around 0.8560 and 0.8600.

During the quote’s extended run-up past-0.8600, a daily closing beyond the 50% Fibonacci retracement level of 0.8650 will be the strong upside signal.

EUR/GBP daily chart

Trend: Pullback expected