USD/CHF Price Analysis: 50-day SMA challenges further declines

- USD/CHF trades near a three-week low.

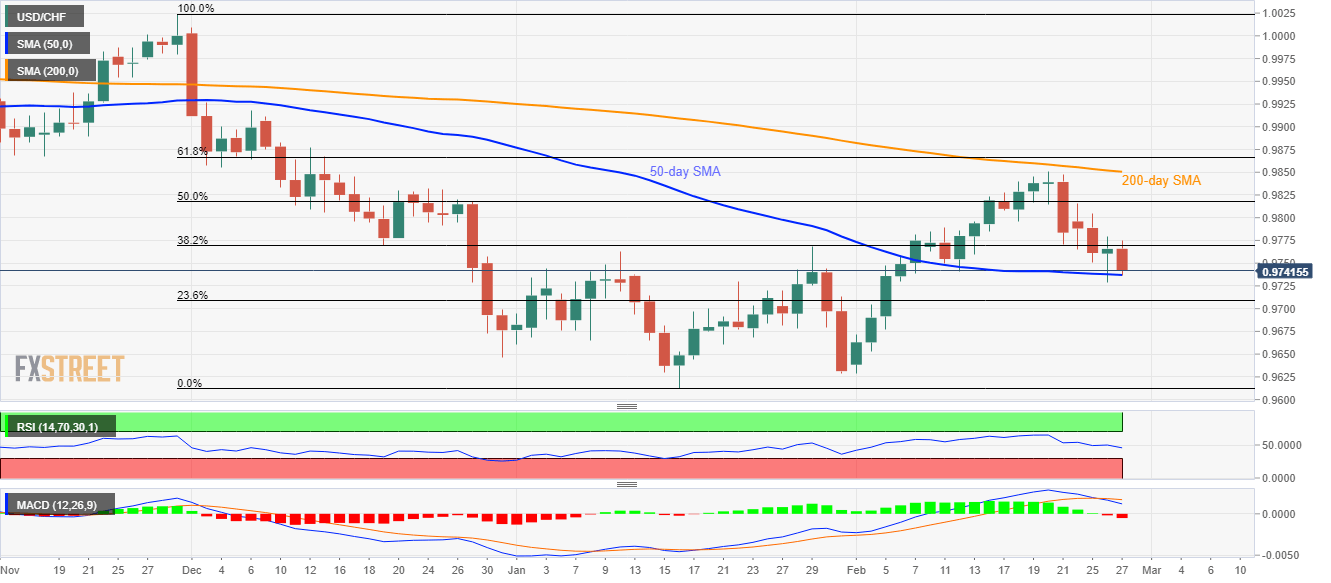

- Bearish MACD, failures to carry the latest recovery keep sellers hopeful, 50-day SMA acts as near-term key support.

- 200-day SMA, 61.8% Fibonacci retracement act as near-term key resistances.

USD/CHF remains on the back foot around 0.9740, down 0.25%, during the initial trading session on Thursday. That said, the quote fails to carry the previous day’s recovery gains.

Even so, a 50-day SMA level of 0.9737 acts as the near-term key support stopping the sellers despite bearish MACD.

Should prices provide a daily closing below 0.9737, 23.6% Fibonacci retracement of the pair’s declines from November 2019 to January 2020, at 0.9709, can flash on the chart.

Assuming the USD/CHF pair’s extended weakness below 0.9709, 0.9700 round-figure and the yearly low surrounding 0.9650 will be in focus of the bears.

On the contrary, 50% Fibonacci retracement level around 0.9820, 200-day SMA figures of 0.9851 and 61.8% of Fibonacci retracement, at 0.9865, cap the pair’s short-term recovery.

USD/CHF daily chart

Trend: Bearish