Back

29 Apr 2020

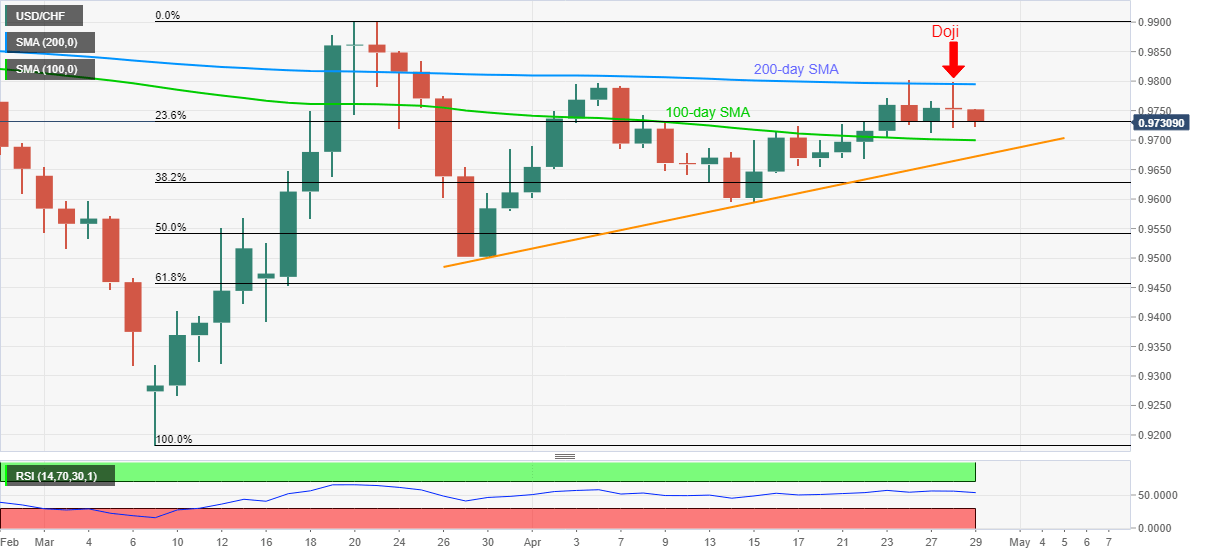

USD/CHF Price Analysis: Tuesday’s Doji below 200-day SMA keep bears hopeful

- USD/CHF justifies the previous day’s trend reversal signaling candlestick formation.

- 100-day SMA, monthly support line are on the bears’ radars.

- March high can lure the bulls past-200-day SMA.

USD/CHF justifies Tuesday’s bearish Doji while declining to 0.9730, down 0.22% on a day, amid the pre-European session on Wednesday.

Not only the candlestick but the pair’s inability to cross 200-day SMA also favors the sellers.

As a result, the pair’s drop to 100-day SMA level of 0.9700 becomes imminent while an ascending trend line from March 30, currently near 0.9670, could question the bears afterward.

It should also be noted that the pair’s further downside past-0.9670 can make it vulnerable to refresh the monthly bottom under 0.9600.

Meanwhile, a sustained upside break above 0.9800, comprising 200-day SMA, enables the quote to challenge March month high close to 0.9900.

USD/CHF daily chart

Trend: Further downside likely