Gold Price Analysis: XAU/USD bears lining up for potential phase of distribution

- XAU/USD is bullish, although $1,800 target could be last stop before the distribution phase.

- CFTC data shows specs grew their short positioning amid worries that prices were too 'toppy'.

- A 50% mean reversion from $1,800 opens compelling high volume zone.

Gold prices are elevated and money managers have aggressively increased their long exposure, according to the latest CFTC data, as gold was readying an attempt to break above $1,800 for the third time this year.

The increase in long positions was also driven by a weakening USD and a slide in real yields, as inflation expectation increases outpaced a rise in yields across the curve, driving real rates lower, analysts at TD Securities have explained, adding:

Higher vols also likely drove some systematic traders out of their large long positions.

However, as gold was readying for a break higher, some specs grew their short positioning amid worries that prices were too 'toppy'.

The second wave of the COVID-19 outbreak in the US, mainly in states like Texas, Florida and Arizona is an additional factor for markets opening this week which could help towards the price of gold to the psychological $1,800 target, or at least the $1,790s.

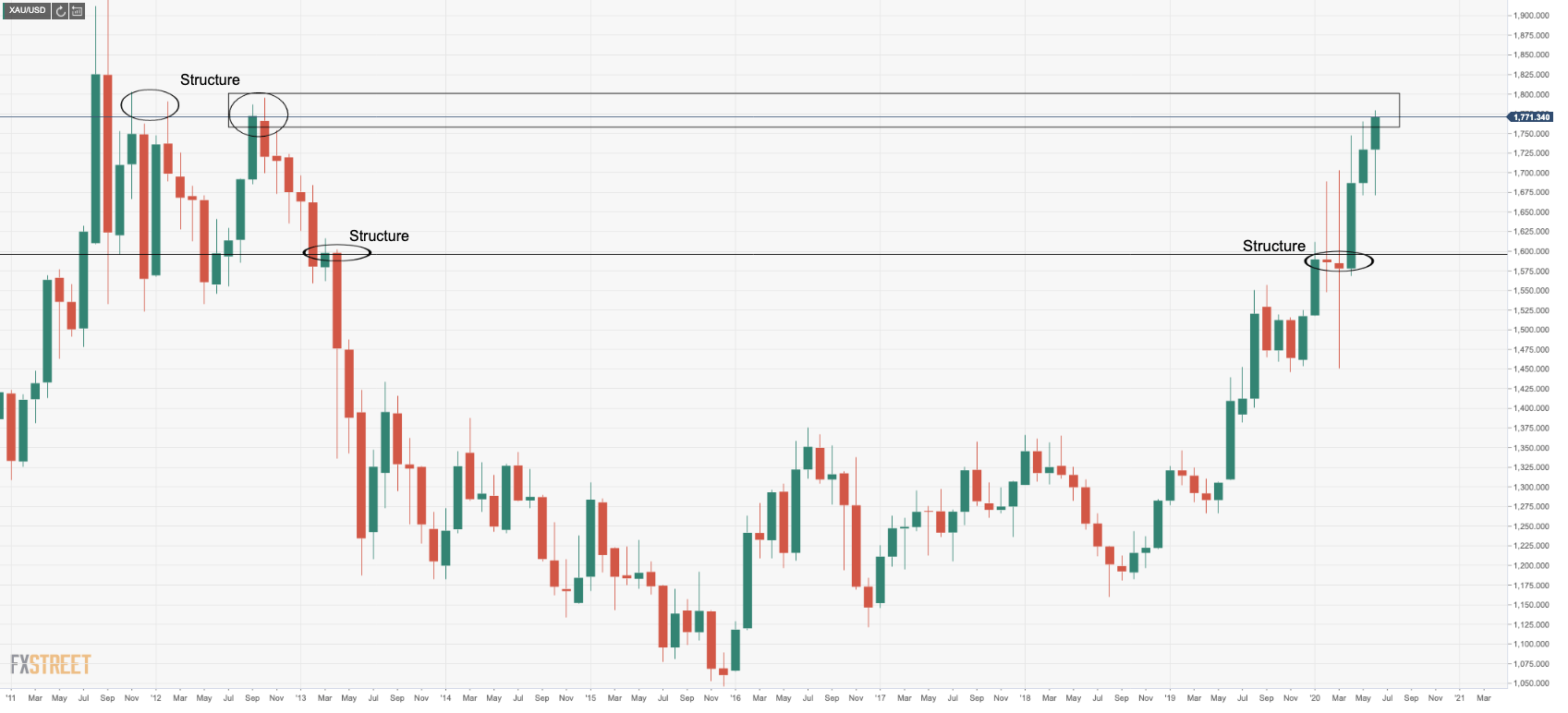

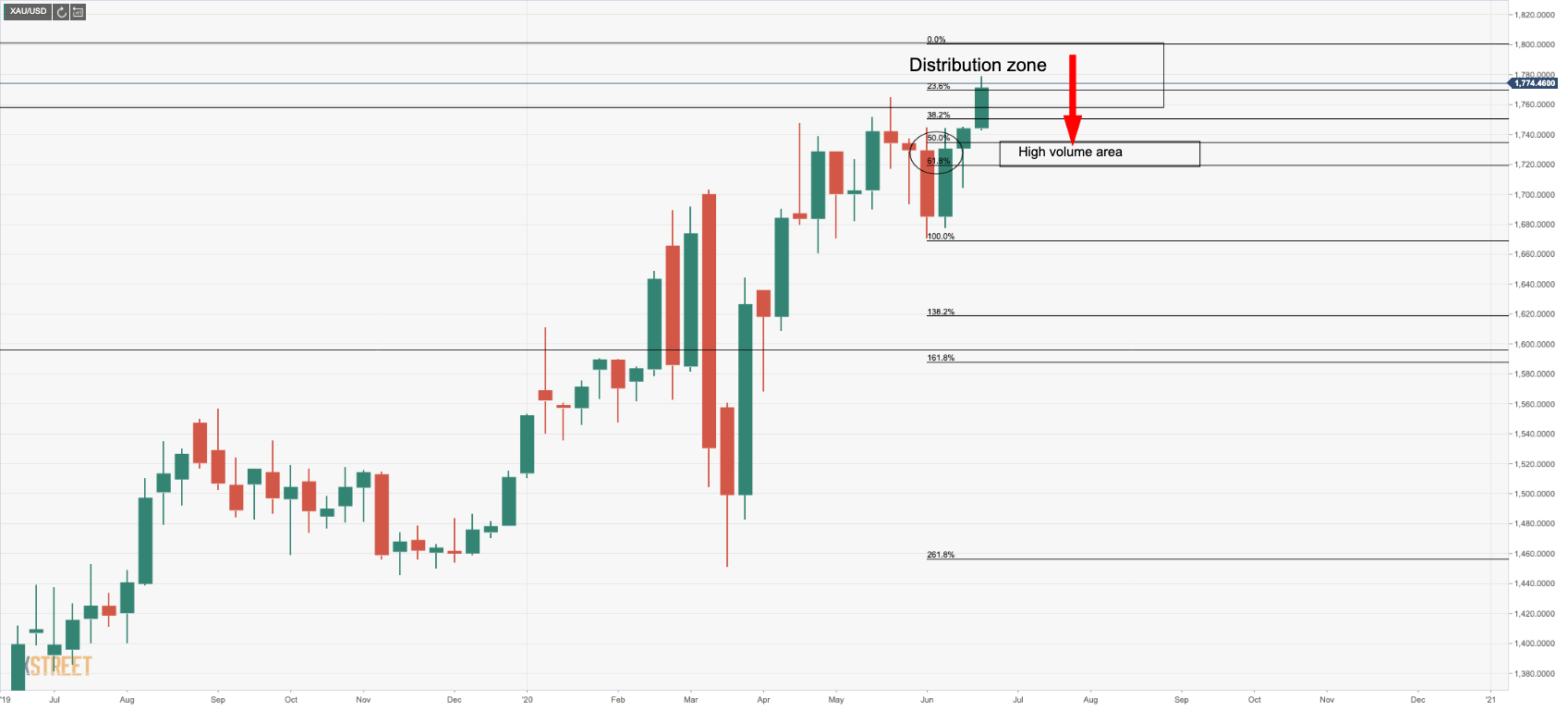

On a multi-timeframe analysis, we can see that the market is approaching a very strong resistance area where a reaction is expected.

Monthly chart

Weekly chart

As can be seen, while the market is bullish, the higher risk to reward at this juncture would be from the short side on an opportunity within a phase of distribution from said resistance zone.

A 50% mean reversion from the $1,800 level would be a compelling area in the $1,720/40 zone where price had been agreed.