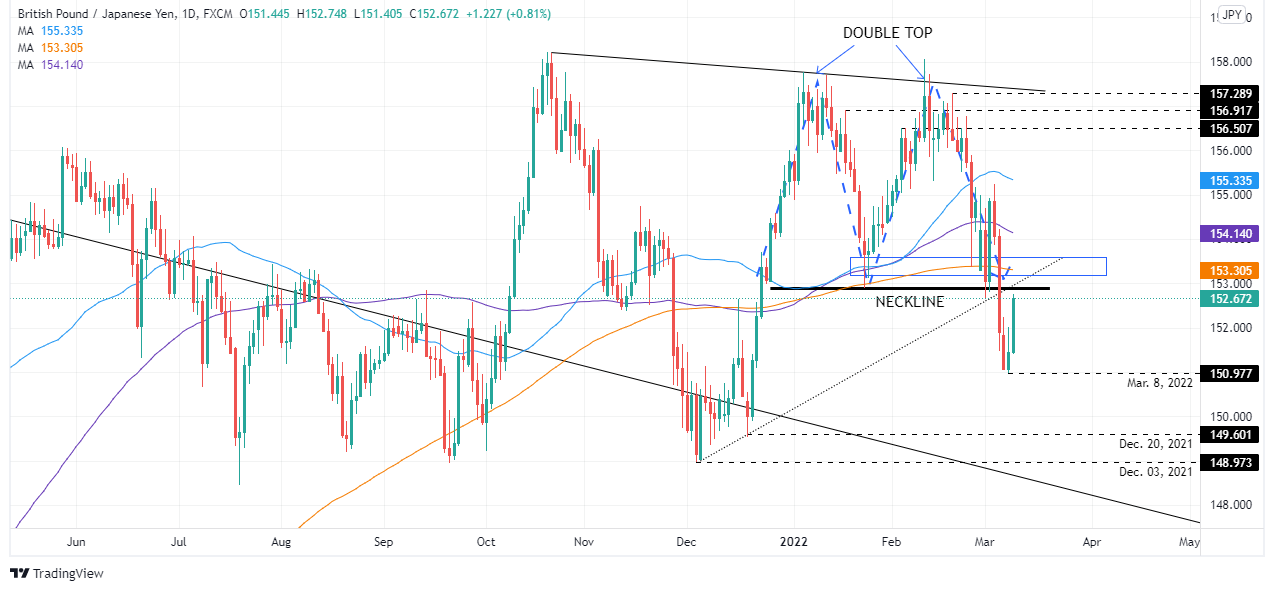

GBP/JPY Price Analysis: Respects double-top neckline, meanders around 152.60s

- The GBP/JPY trims last week’s losses, though stills below a double-top neckline, as downside risks remain.

- A risk-on market mood, dented appetite for the safe-haven JPY.

- GBP/JPY Technical Outlook: The retest of a double-top in the daily chart opens the door for renewed selling pressure.

The British pound recovers some ground vs. the Japanese yen on a slight improvement on market sentiment, but the rally stalled at the neckline of a double-top chart pattern, with a target of 148.00. At the time of writing, the GBP/JPY is trading at 152.67 during the North American session.

US equities reflect the improvement in market mood, rallying between 2% and 3.58%, as Ukraine shows is ready to resume talks with Russia. On Tuesday, in an interview with ABC, Ukrainian President Volodymyr Zelensky commented that he is prepared for dialog and reiterated that Ukraine lost its interest to join NATO.

GBP/JPY overnight rallied once the Asian Pacific session began, on the news that Ukraine was no longer interested in joining NATO, jumping 50-pips near the 152.00 mark ahead of the European session. Once European traders joined their offices, the GBP/JPY printed its second leg-up and recorded the daily high at 152.72.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is downward biased, and Wednesday’s rally offered JPY bulls a better entry price, in the case of having missed the March 4, 250-pip fall from 154.20s. The GBP/JPY neckline lies at 152.94 and would be a problematic resistance level to overcome for GBP bulls due to the increased selling pressure linked to the double-top.

That said, the GBP/JPY first support would be March 8 daily low at 150.97. Breach of the latter would expose last year’s crucial support levels, lead by December 20 low at 149.60, followed by the December 3 low at 148.97, and the double-top target at 148.00.